Floating Debt Definition . A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. The interest rate for an frn is tied to a benchmark rate. Debt on which the interest rate changes as the existing rate changes.

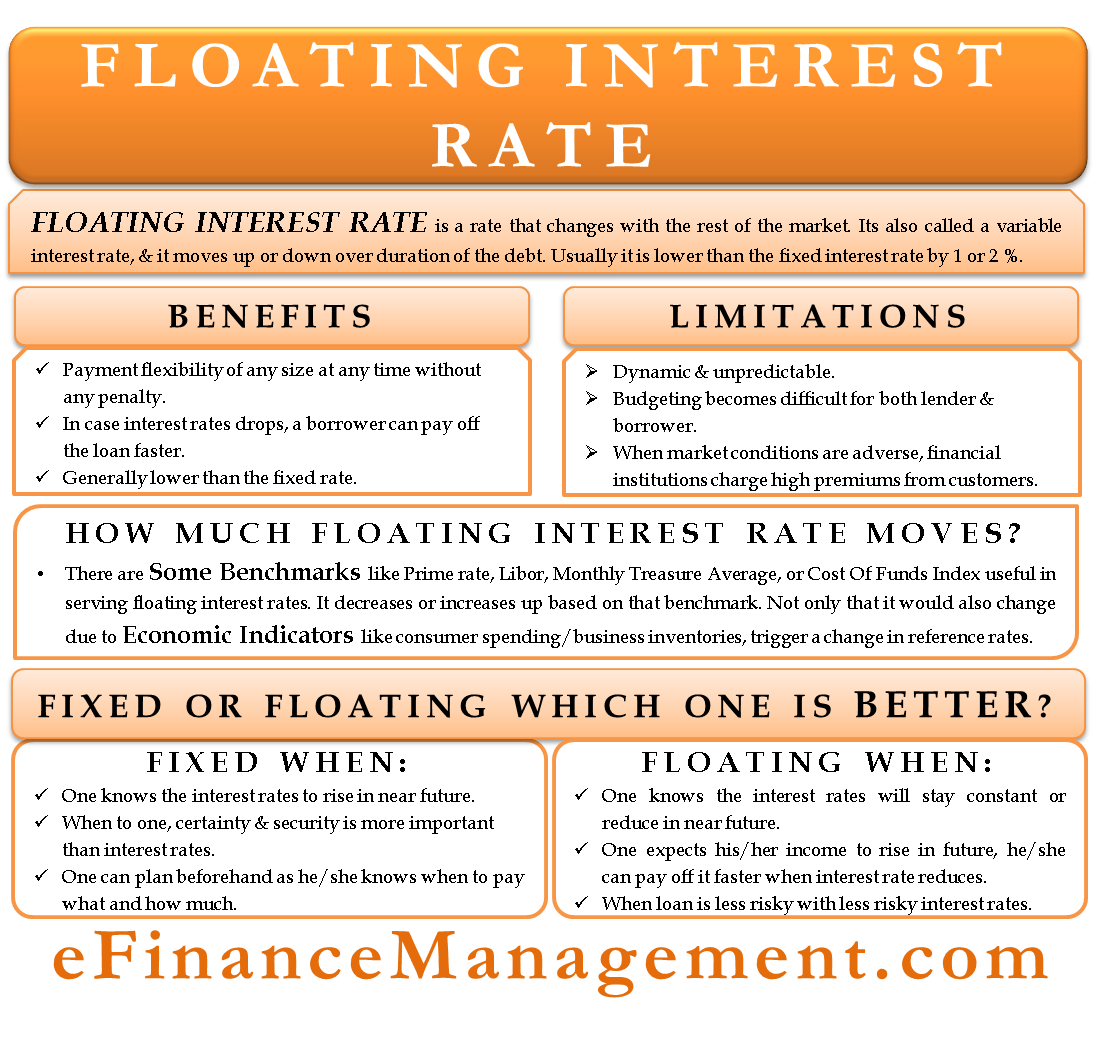

from efinancemanagement.com

Debt on which the interest rate changes as the existing rate changes. Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. The interest rate for an frn is tied to a benchmark rate.

Floating Interest Rate What It is And When You Should Choose It?

Floating Debt Definition A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. The interest rate for an frn is tied to a benchmark rate. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Debt on which the interest rate changes as the existing rate changes.

From estradinglife.com

Debt definition Estradinglife Floating Debt Definition Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. The interest rate for an frn is tied to a benchmark rate. Debt on which. Floating Debt Definition.

From marketbusinessnews.com

Debts definition, meaning, and examples Market Business News Floating Debt Definition The interest rate for an frn is tied to a benchmark rate. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Debt on which the interest rate changes as the existing rate changes. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.

From www.investopedia.com

Debt Issue Definition, Process, and Costs Floating Debt Definition Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. The interest rate for an frn is tied to a benchmark rate. Debt on which the interest rate changes as the existing rate changes. A floater is a debt instrument whose interest rate is tied to a benchmark index such. Floating Debt Definition.

From www.youtube.com

(16 of 17) Ch.14 Flotation costs 2 examples YouTube Floating Debt Definition The interest rate for an frn is tied to a benchmark rate. Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Debt on which. Floating Debt Definition.

From efinancemanagement.com

Floating Interest Rate What It is And When You Should Choose It? Floating Debt Definition Debt on which the interest rate changes as the existing rate changes. The interest rate for an frn is tied to a benchmark rate. Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. A floater is a debt instrument whose interest rate is tied to a benchmark index such. Floating Debt Definition.

From www.researchgate.net

(PDF) Synthetic FloatingRate Debt An Example of an AssetDriven Floating Debt Definition The interest rate for an frn is tied to a benchmark rate. Debt on which the interest rate changes as the existing rate changes. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.

From www.youtube.com

Y1112 Economics Floating Exchange Rates YouTube Floating Debt Definition The interest rate for an frn is tied to a benchmark rate. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Debt on which the interest rate changes as the existing rate changes. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.

From www.dreamstime.com

A Creative Concept of a Message in a Bottle Saying Debt Floating on Floating Debt Definition Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Debt on which the interest rate changes as the existing rate changes. The interest rate. Floating Debt Definition.

From www.moneycrashers.com

What Are Floating Rate Mutual Funds Pros & Cons and Examples Floating Debt Definition Debt on which the interest rate changes as the existing rate changes. Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. The interest rate for an frn is tied to a benchmark rate. A floater is a debt instrument whose interest rate is tied to a benchmark index such. Floating Debt Definition.

From www.bwl-lexikon.de

Floating Rate Note » Definition, Erklärung & Beispiele + Übungsfragen Floating Debt Definition The interest rate for an frn is tied to a benchmark rate. Debt on which the interest rate changes as the existing rate changes. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.

From www.researchgate.net

Parameters and Variables used in the simulation with floating debt Floating Debt Definition Debt on which the interest rate changes as the existing rate changes. The interest rate for an frn is tied to a benchmark rate. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.

From www.indiabonds.com

What are Floating Rate Bonds? IndiaBonds Floating Debt Definition A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. The interest rate for an frn is tied to a benchmark rate. Debt on which the interest rate changes as the existing rate changes. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.

From www.investopedia.com

What Is LongTerm Debt? Definition and Financial Accounting Floating Debt Definition Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. The interest rate for an frn is tied to a benchmark rate. Debt on which the interest rate changes as the existing rate changes. A floater is a debt instrument whose interest rate is tied to a benchmark index such. Floating Debt Definition.

From www.youtube.com

Floating Rate Funds a unique debt investment YouTube Floating Debt Definition The interest rate for an frn is tied to a benchmark rate. Debt on which the interest rate changes as the existing rate changes. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.

From efinancemanagement.com

Sources of Finance OwnedBorrowed, LongShort Term, InternalExternal Floating Debt Definition Debt on which the interest rate changes as the existing rate changes. The interest rate for an frn is tied to a benchmark rate. Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. A floater is a debt instrument whose interest rate is tied to a benchmark index such. Floating Debt Definition.

From blog.shoonya.com

Understanding Floating Rate Bonds Floating Debt Definition Debt on which the interest rate changes as the existing rate changes. The interest rate for an frn is tied to a benchmark rate. Floating debt refers to a type of financial obligation that does not have a fixed repayment schedule or maturity date. A floater is a debt instrument whose interest rate is tied to a benchmark index such. Floating Debt Definition.

From pkmongobot.com

How Debt Financing Works, Examples, Costs, Pros & Cons (2024) Floating Debt Definition Debt on which the interest rate changes as the existing rate changes. The interest rate for an frn is tied to a benchmark rate. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.

From www.wallstreetmojo.com

Debt Meaning, Types, Examples, Pros & Cons, How it Works? Floating Debt Definition Debt on which the interest rate changes as the existing rate changes. A floater is a debt instrument whose interest rate is tied to a benchmark index such as libor, which is known as its reference rate. The interest rate for an frn is tied to a benchmark rate. Floating debt refers to a type of financial obligation that does. Floating Debt Definition.